This is to allow landing cost to be distributed and added onto item cost during purchases.

Go to Tools > Program Control > Module Setting

Check the checkbox of Landing Cost to enable it.

Default Setting

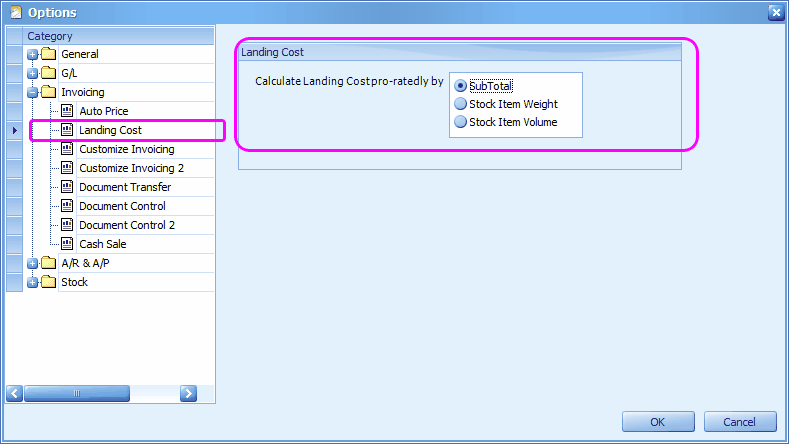

Go to Tools > Options > Invoicing > Landing Cost

Select default option for Calculate Landing Cost Pro-Rated by

Pro-rated by Sub Total: landing cost will be distributed among transacted items according to the ratio of each item row's subtotal. E.g.

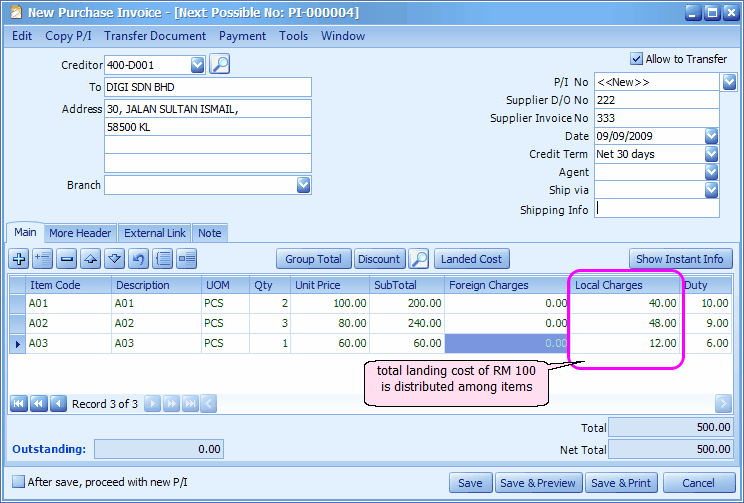

Total landing cost = 100.00

Item A, Qty=2, Unit Price=100, Sub Total = 200 Pro-rated landing cost = 200/500 * 100 = 40.00

Item B, Qty=3, Unit Price=80, Sub Total = 240 Pro-rated landing cost = 240/500 * 100 = 48.00

Item C, Qty=1, Unit Price=60, Sub Total = 60 Pro-rated landing cost = 60/500 * 100 = 12.00

Pro-rated by Stock Item Weight: landing cost will be distributed among transacted items according to the ratio of each item row's total weight; item weight is maintained at Stock Item Maintenance. E.g.

Total landing cost = 100.00

Item A, Qty=2, Item Weight=10 kg, Total Weight= 20 Pro-rated landing cost = 20/50 * 100 = 40.00

Item B, Qty=3, Item Weight=8 kg, Total Weight= 24 Pro-rated landing cost = 24/50 * 100 = 48.00

Item C, Qty=1, Item Weight=6 kg, Total Weight= 6 Pro-rated landing cost = 6/50 * 100 = 12.00

Pro-rated by Stock Item Volume: landing cost will be distributed among transacted items according to the ratio of each item row's total volume; item volume is maintained at Stock Item Maintenance. E.g.

Total landing cost = 100.00

Item A, Qty=2, Item Volume=10 litre, Total Volume= 20 Pro-rated landing cost = 20/50 * 100 = 40.00

Item B, Qty=3, Item Volume=8 litre, Total Volume= 24 Pro-rated landing cost = 24/50 * 100 = 48.00

Item C, Qty=1, Item Volume=6 litre, Total Volume= 6 Pro-rated landing cost = 6/50 * 100 = 12.00

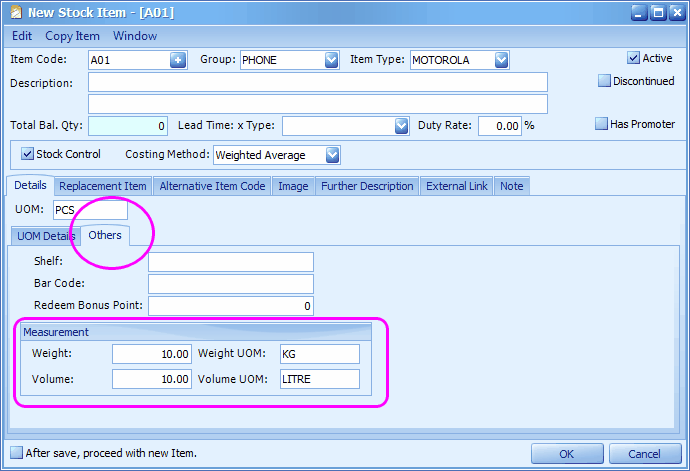

To maintain item weight and item volume, go to Stock > Stock Item Maintenance,

Click on Others,

Transaction - Purchase

Landing Cost is applicable on Goods Received Note, Purchase Invoice and Cash Purchase.

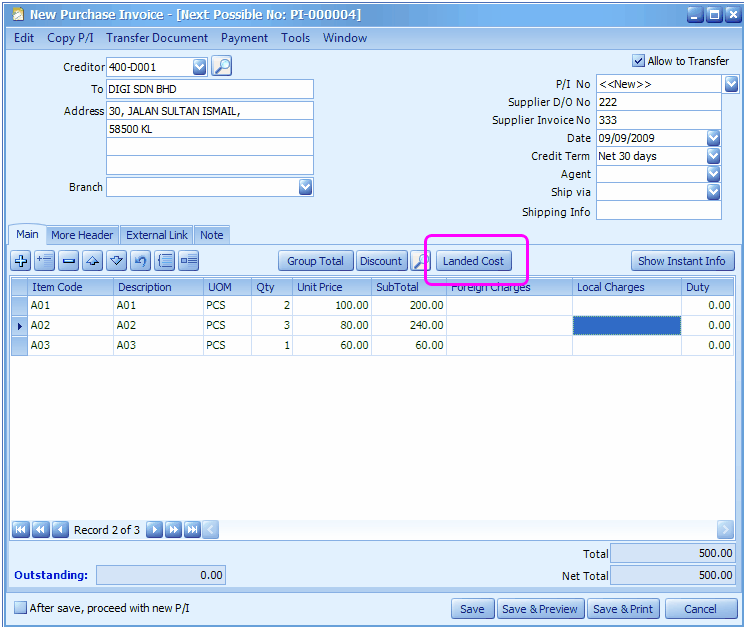

Go to Purchase > Purchase Invoice

Click on Create A New Purchase Invoice

Add 3 different items...

Click on Landed Cost button,

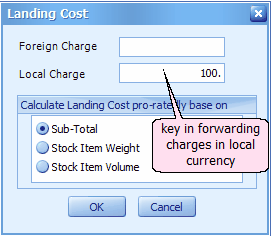

Foreign Charge: if landing cost was charged by service provider in foreign currency, key in foreign charge amount. This amount will be distributed and filled in the column of Foreign Charge.

Local Charge: if landing cost was charged by service provider in local currency (or converted to local currency), key in local charge amount. This amount will be distributed and filled in the column of Local Charge.

Calculate Landing Cost Pro-rated base on: select an option.

Click on OK.

The column of Local Charge is filled with landing cost.

Distribution of landing cost is applicable only on stock items. If there is a mixture of Stock items and Service items, the service items will not be included in pro-rated distribution.

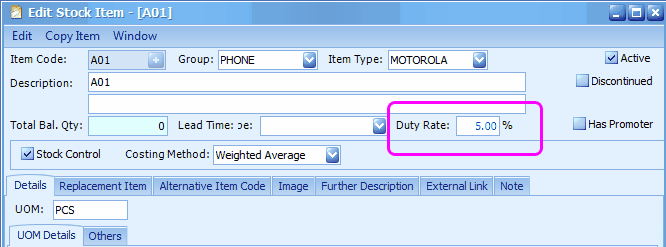

You may also key in Duty charge (in value) per each item (if any). The duty rate (in %) can be maintained at Stock Item Maintenance so that it will be auto-calculated (yet amendable).

Note: Purchase cost per unit therefore, will be... (Subtotal + Local Charge + Duty) / Qty

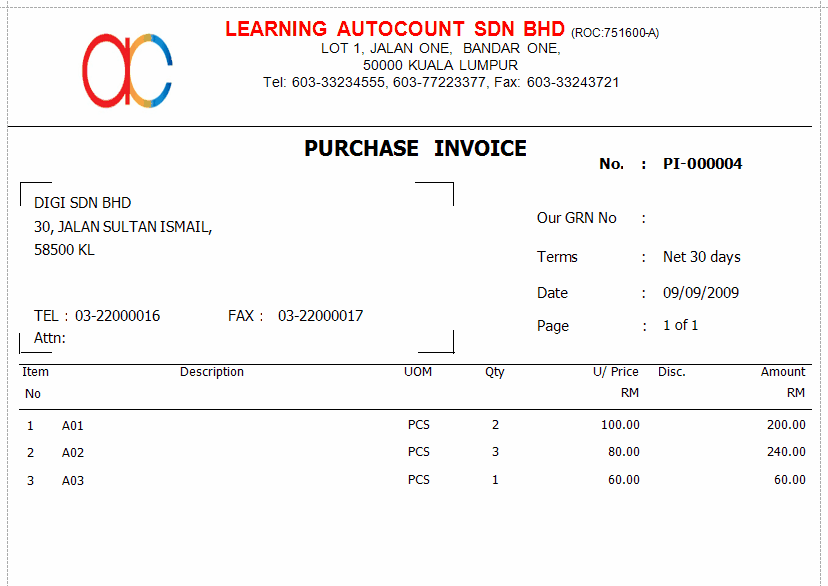

Click on Save & Preview.

Both Landing charge and Duty are for costing purpose and will not be displayed in Purchase Invoice.

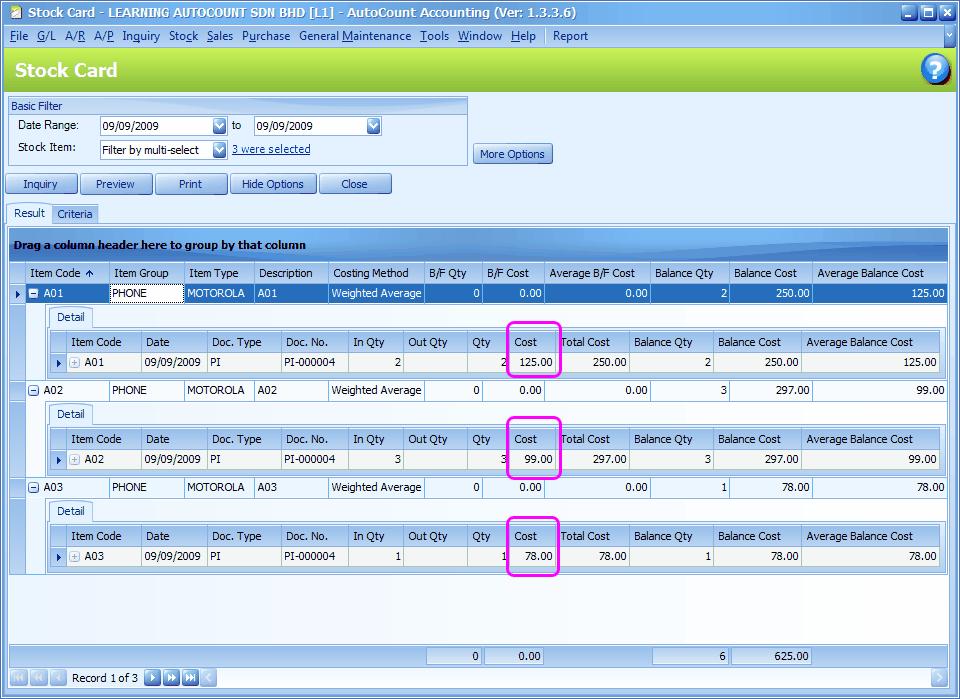

Stock Card Report

Go to Stock > Stock Card Report

Define filter options, click on Inquiry, click on '+' sign before item code to expand the details.

As you can see, landing cost was added to stock unit cost.

Posting - A/P Invoice

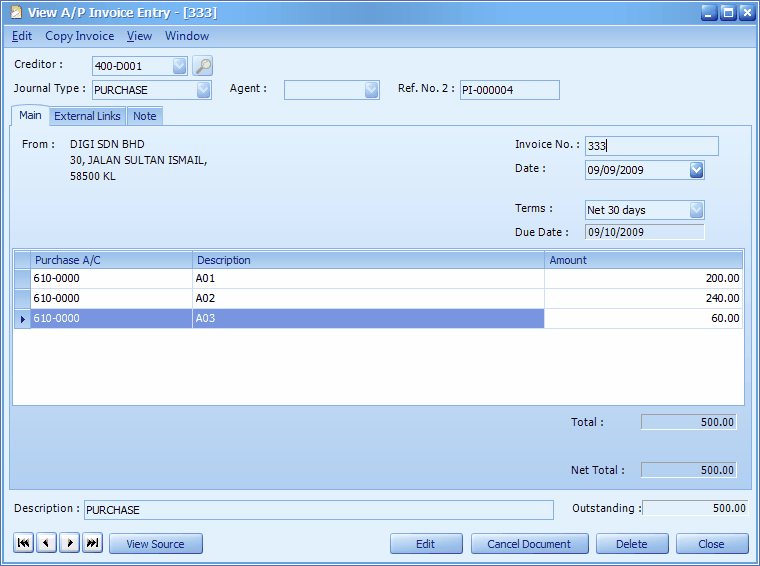

Go to A/P > A/P Invoice Entry

Select the Purchase Invoice you have just saved, click on View

You will notice that A/P Invoice Entry does not include landing cost and Duty charge.

For total Landing Cost and total Duty Charge, there are separate invoices billed by respective supplier, and will be recorded with separate Purchase Invoices or A/P Invoice Entries (G/L accounts involved should be Cost Of Sale type and not Expenses type.).

Landing Cost vs Profit & Loss Statement

To make it easier to understand the consequences of Landing Cost in Profit & Loss Statement after all necessary entries, i shall use an extreme example where the purchased stock was not sold at all ...

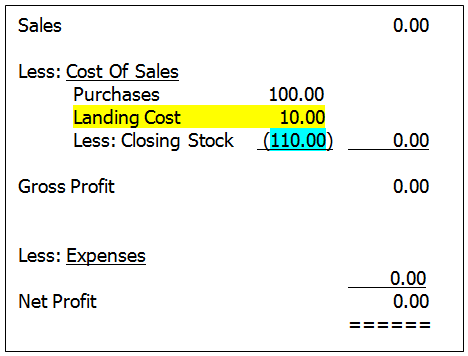

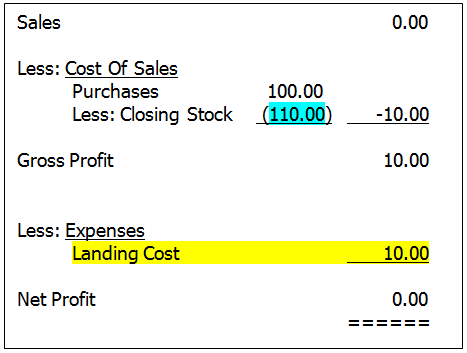

Example 1: Landing Cost module is used to adjust the stock value:

Sales: 0 (there was no sales, so the closing stock is remained unsold)

Purchases: 100

Landing Cost: 10

(A) if the Landing Cost Account is created under COST OF SALES account type:

The Profit & Loss Statement will be:

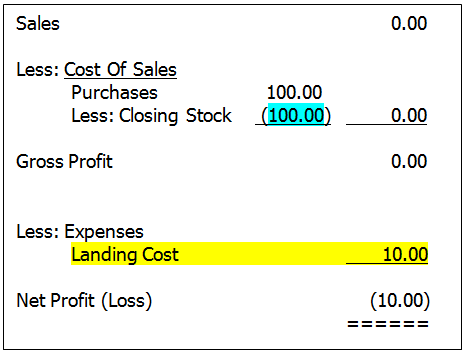

(B) if the Landing Cost Account is created under Expenses account type:

The Profit & Loss Statement will be:

Both end up with the same Net Profit amount, but with different Gross Profit amount.

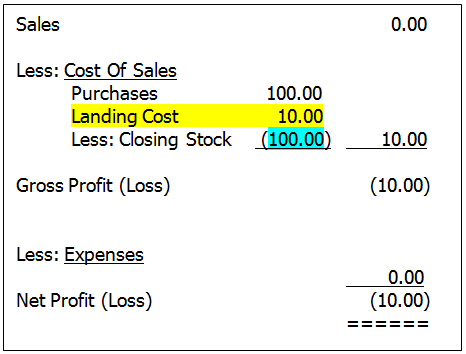

Example 2: Landing Cost module is NOT used.

Sales: 0 (there was no sales, so the closing stock is remained unsold)

Purchases: 100

Landing Cost: 10

(A) if the Landing Cost Account is created under COST OF SALES account type:

The Profit & Loss Statement will be:

(B) if the Landing Cost Account is created under Expenses account type:

The Profit & Loss Statement will be:

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.