Here you maintain GST tax types at your own definition.

This menu is available only when the checkbox of Use Goods and Services Tax (Tax Types) is checked at Tools > Options > General > Goods and Services Tax.

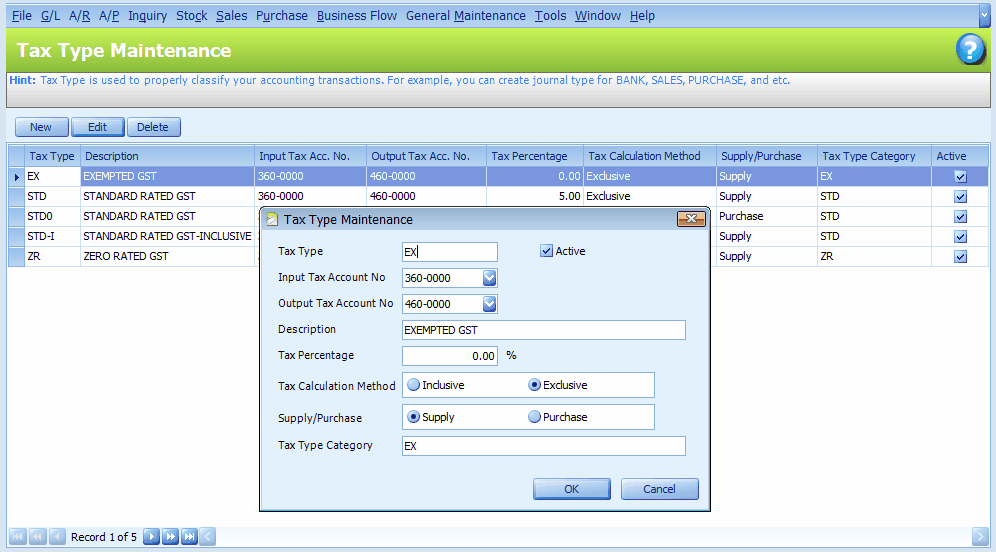

Go to General Maintenance > Tax Type Maintenance

You may click on New to add a new method,

Tax Type: key in your tax type code. You may also use the Tax Code provided by the tax authority.

Active: check this checkbox if this tax type is in use.

Input Tax Account No.: assign the Input Tax Account (or Purchase Tax Account) for posting purpose. If you have not maintained any of such accounts, create one at Account Maintenance.

Output Tax Account No.: assign the Output Tax Account (or Sales Tax Account) for posting purpose. If you have not maintained any of such accounts, create one at Account Maintenance.

Description: the description of this tax type. You may use the tax type description provided by the tax authority.

Tax Percentage: this is the tax rate as announced by the tax authority.

Tax Calculation Method: select either this tax type is Inclusive or Exclusive. Inclusive means the tax is included in sales/purchase price, which means actual sales/purchase value will be = Sales or Purchase Price / (1+ r) .... where r is the tax rate.

Supply/Purchase: define the category of this tax type, either Supply (or Sales), or Purchase.

Tax Type Category: key in the tax type category for reporting purpose (Tax Transaction Listing Report)

Also refer to:

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.