This module allows transaction in multi-currency. The system will auto-calculate gain/loss in currency exchange and post to Journal and G/L entries accordingly.

Go to Tools > Program Control > Module Setting

Check the checkbox of Multi Currency to enable it.

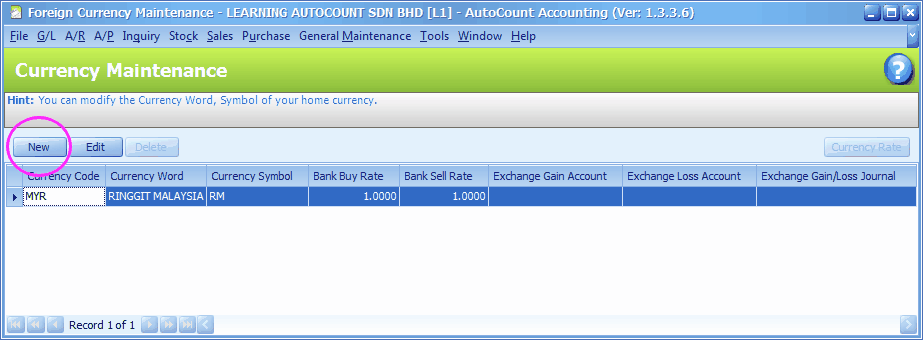

Maintain Foreign Currency

Go to General Maintenance > Currency Maintenance

By default, Home Currency is created.

Click on New to add a currency.

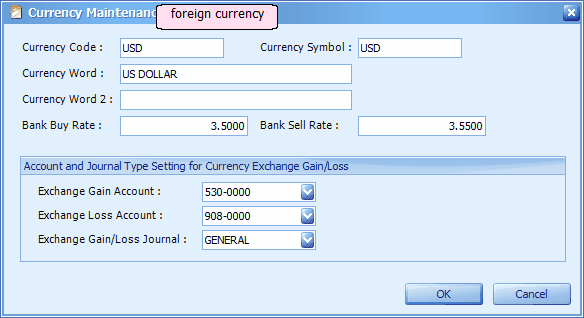

Currency Code: key in a unique currency code

Currency Symbol: key in currency symbol

Currency Word: key in the name of currency in words

Currency Word 2: key in an alternative name of the currency (if any)

Bank Buy Rate: key in default exchange rate when you are selling this currency (USD) to bank for home currency (MYR).

Bank Sell Rate: key in default exchange rate when you are buying this currency (USD) from bank with home currency (MYR)

Account and Journal Type Setting for Currency Exchange Gain/Loss: this setting is needed for each currency (including Home Currency) if you are using multi-currency.

Exchange Gain Account: select the Gain On Foreign Exchange Account

Exchange Loss Account: select the Loss On Foreign Exchange Account

Exchange Gain/Loss Journal: select the journal type of Gain/Loss journal entries

Click on OK.

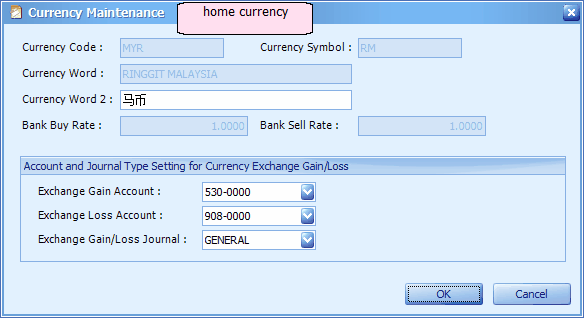

Highlight home currency (MYR) and click on Edit to assign G/L accounts and Journal type,

Click on OK.

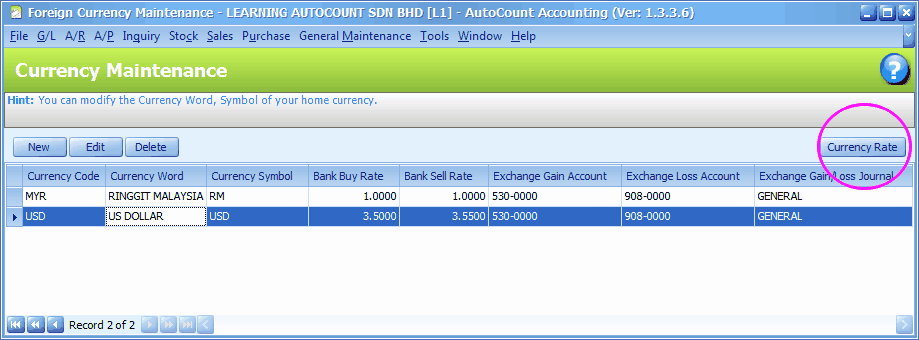

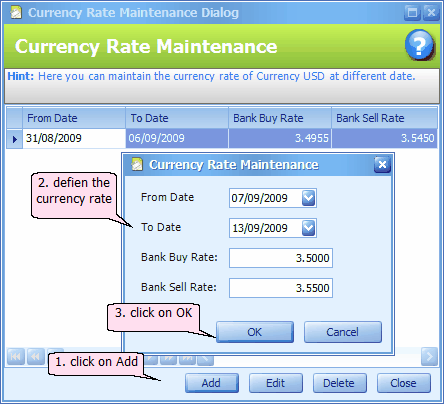

Highlight a foreign currency,

Click on Currency Rate button,

You may click on Add to maintain currency rates for specific date/period. During transaction, these rates will be captured instead of the defaulted rates.

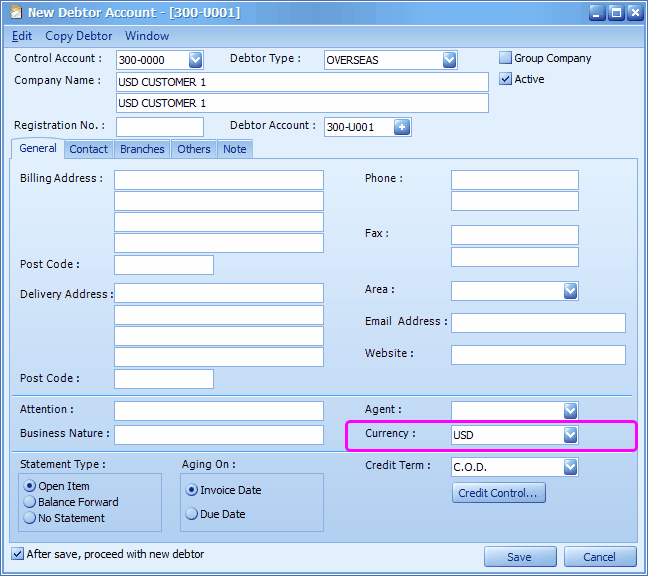

Create Debtor/Creditor with Foreign Currency

Go to A/R > Debtor Maintenance (similarly for A/P > Creditor Maintenance)

Select USD for the Currency field

Note: For a debtor/creditor that trades in foreign currency as well as home currency, you need to maintain separate accounts for different currencies. E.g. 300/A001 Debtor A for RM, and 300/A002 Debtor A for USD.

Click on Save,

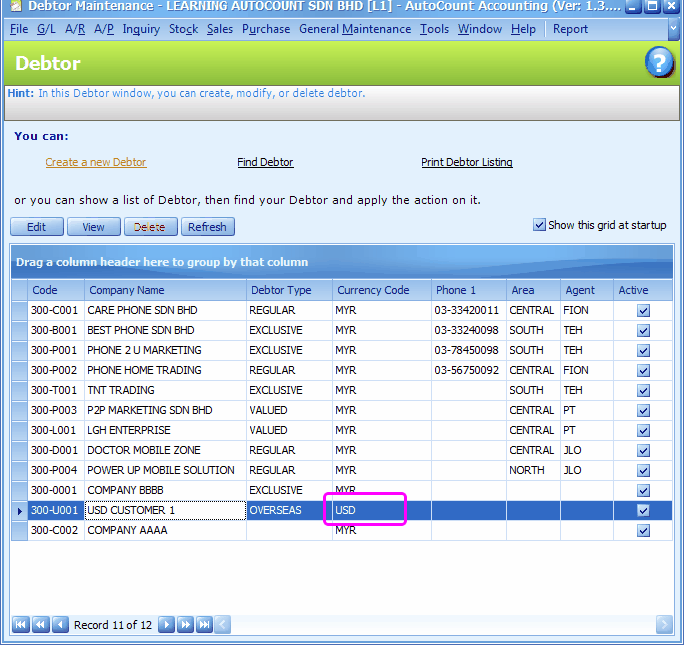

Now in my debtor list, there is a debtor with currency = USD.

Invoice in Foreign Currency

Go to Sales > Invoice

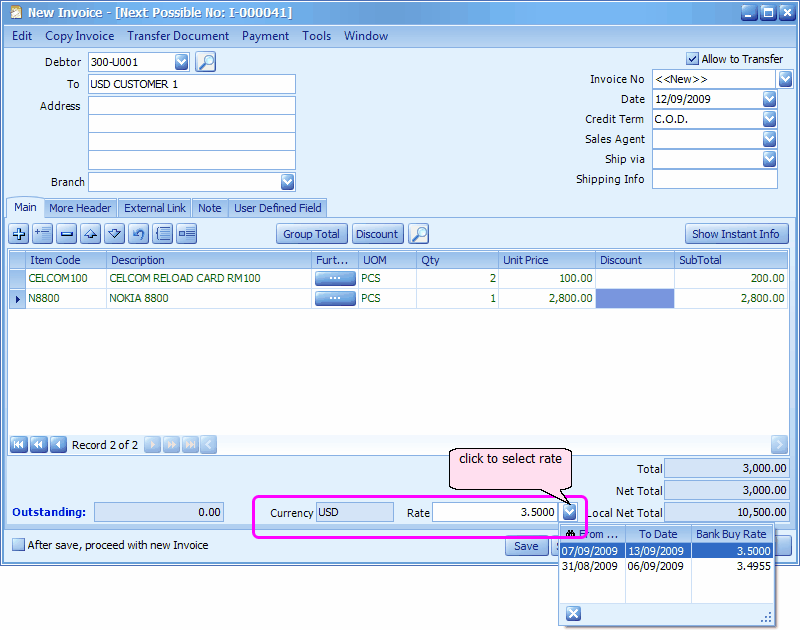

Click on Create A New Invoice,

Select a debtor with foreign currency,

Add few items (be aware that now the prices are in USD),

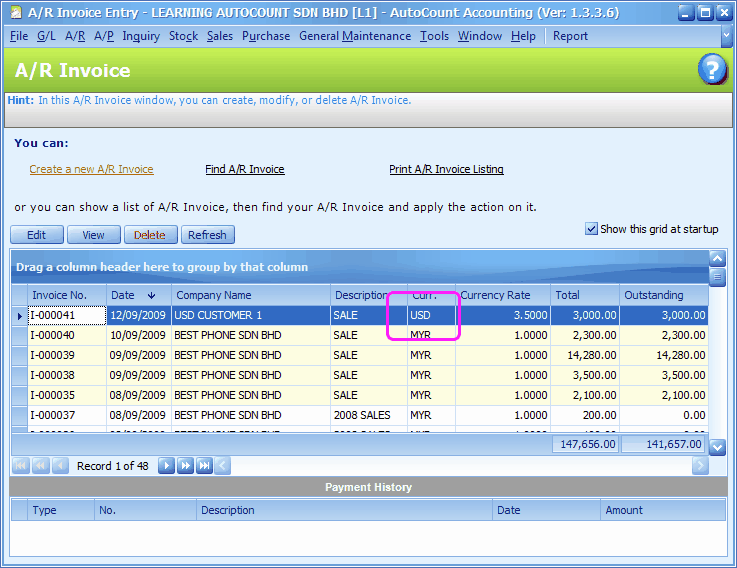

At footer, default currency rate is adopted to arrive at Local Net Total.

To modify exchange rate, you may key in any rate or click on the drop down button to select an earlier maintained rate.

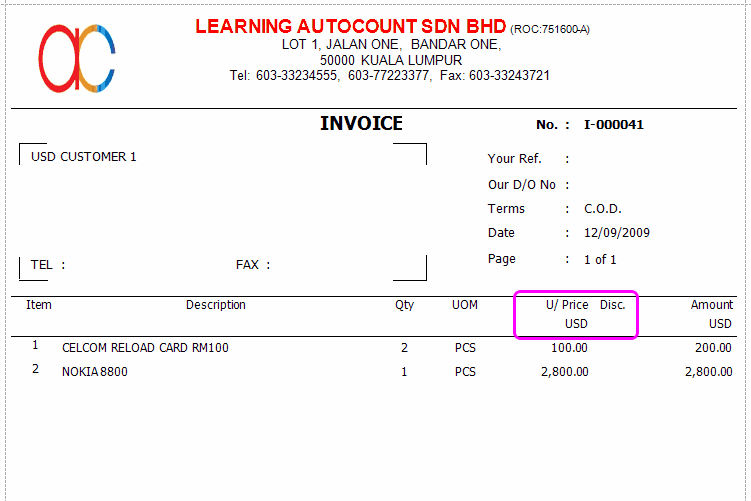

Click on Save and Preview, OK,

The printout invoice is, of course, in USD currency.

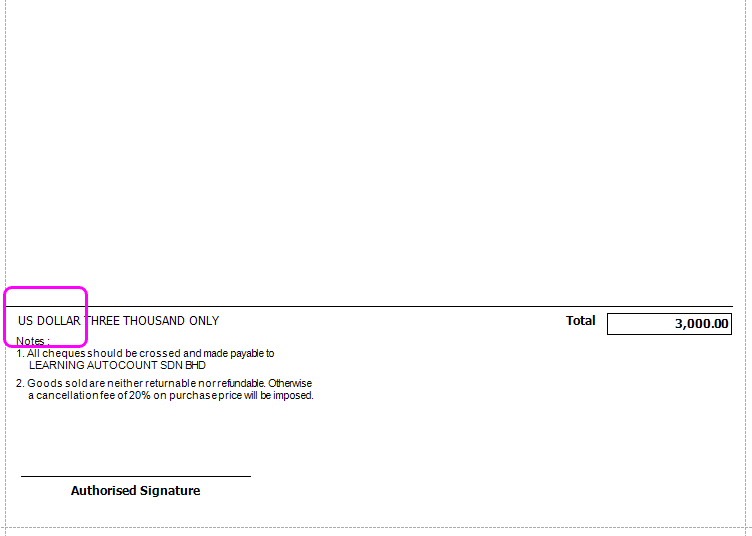

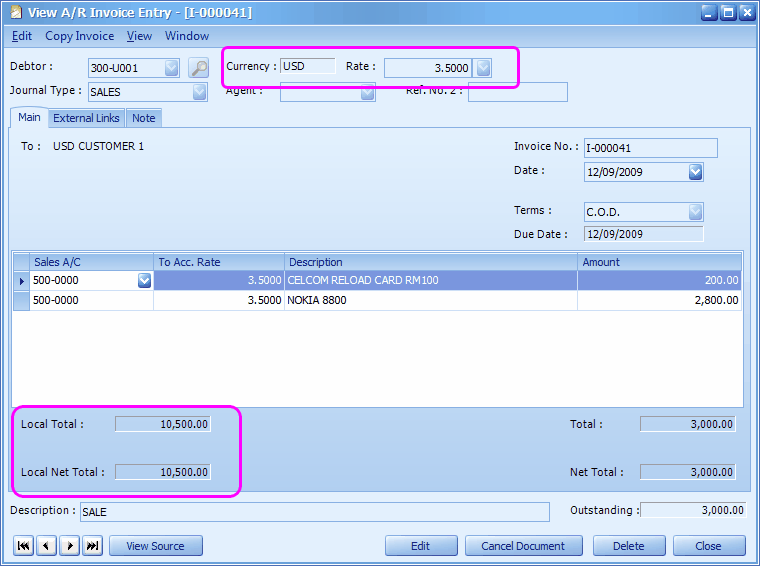

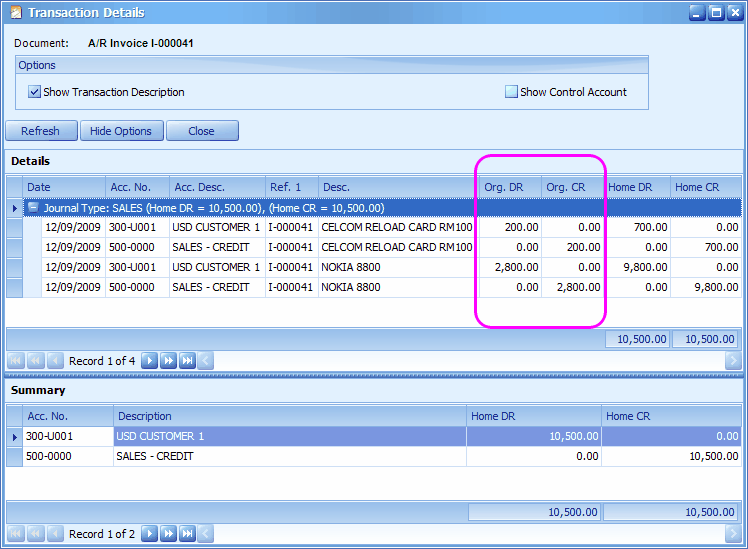

You may go to A/R > A/R Invoice Entry to locate the posted entry.

Double click on an Invoice No. (Or highlight an Invoice then click on View)

Click on View > View Posting Details (or press Ctrl + F11)

Let's create a new A/R Invoice Entry ... directly from A/R menu.

A/R Invoice in Foreign Currency

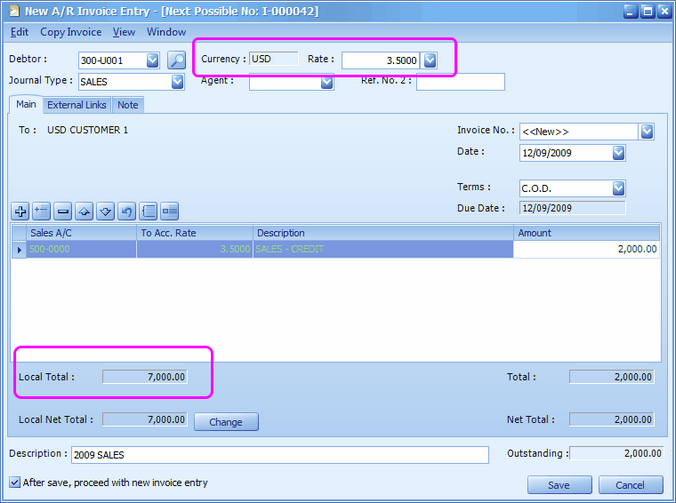

Go to A/R > A/R Invoice Entry

Click on Create A New A/R Invoice,

Select a debtor with foreign currency,

The Currency and default currency rate is displayed,

To change the exchange rate, you may key in any rate or click on the drop down button to select an earlier maintained rate.

Click on '+' to select a sales account, and key in amount (in USD).

Change: click on this button to change Local Net Total; usually used to adjust the rounding of final total.

Click on Save.

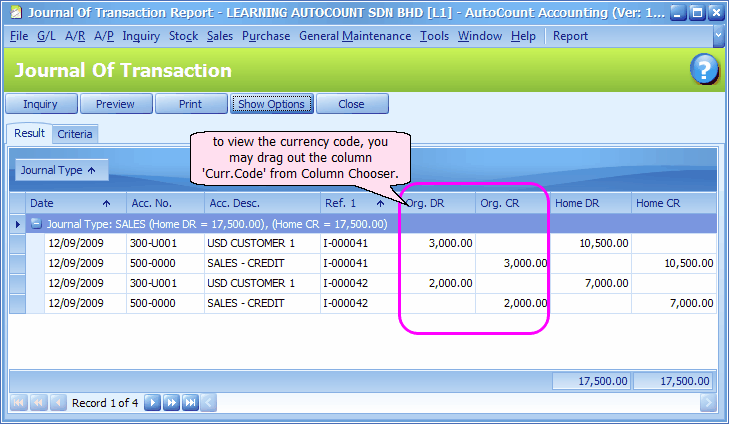

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

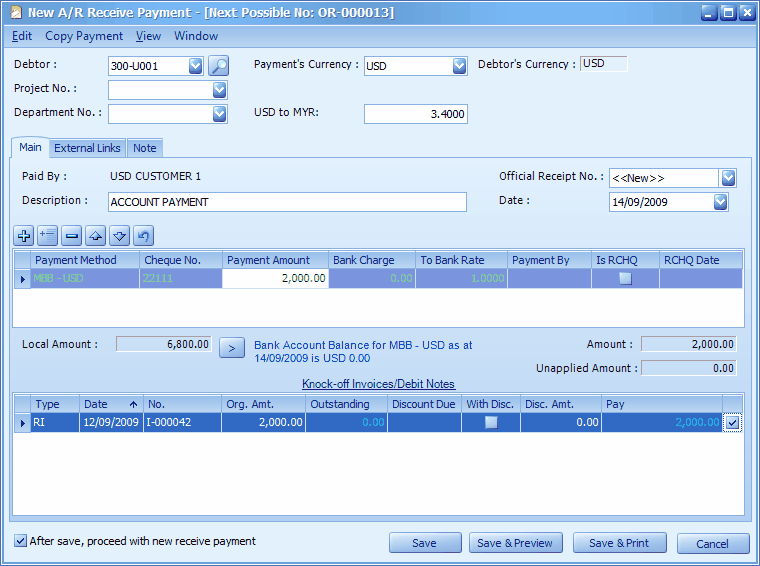

Payment Received in Foreign Currency

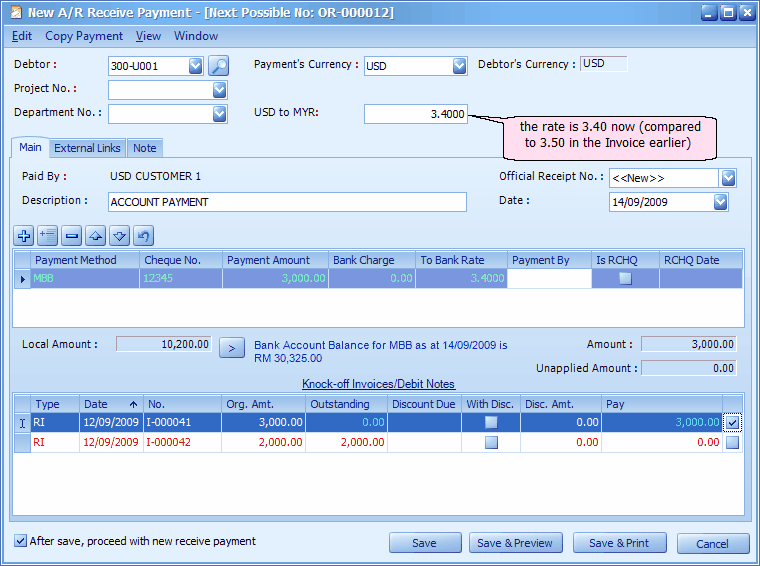

Go to A/R > A/R Receive Payment

Click on Create A New A/R Payment,

Select a debtor with foreign currency,

The Currency and default currency rate is displayed,

Change the USD to MYR rate to 3.40 (so there will be a Loss in Foreign Exchange)

Click on '+' to select a payment method, and key in payment amount (in USD).

Check the checkbox of an invoice to knock off.

Click on Save....

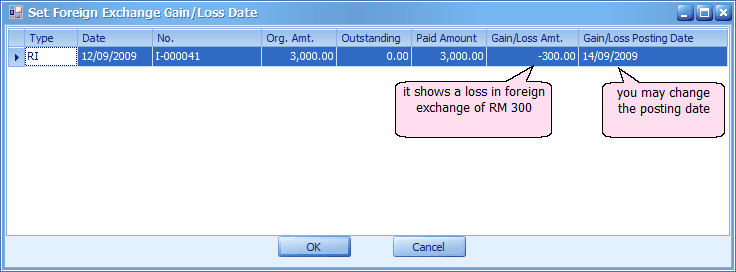

The prompted screen shows there will be a loss in foreign exchange of RM 300, you may click to change the Gain/Loss Posting Date.

Click on OK..

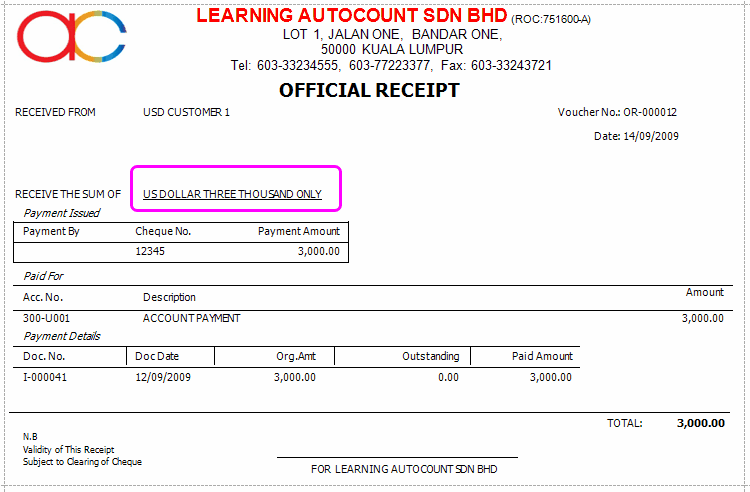

Preview the A/R Payment,

You may go to A/R > A/R Invoice Entry to locate the posted entry.

Double click on the Invoice No. (Or highlight the Invoice then click on View)

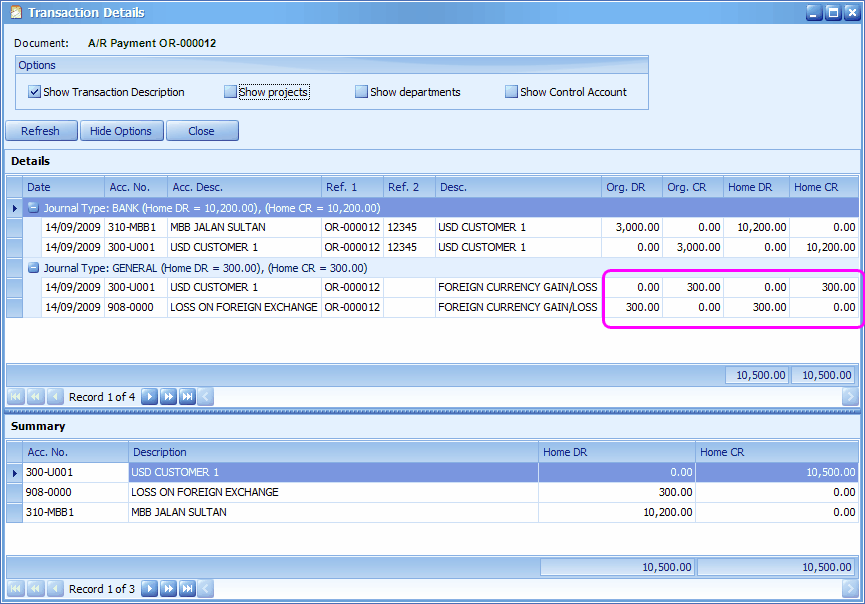

Click on View > View Posting Details (or press Ctrl + F11)

This shows that the system will (base on the payment current rate) auto generate G/L entries should there was a gain/loss in exchange rates.

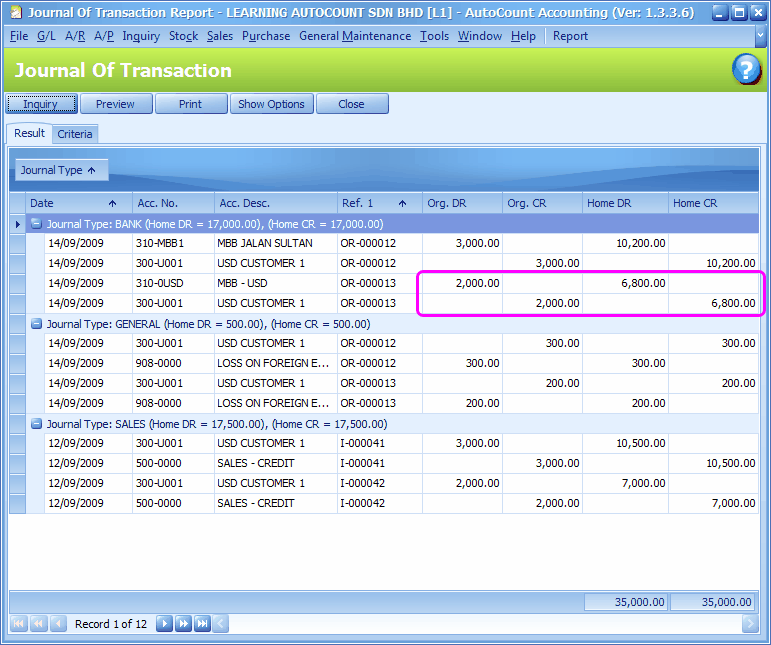

Go to G/L > Journal Of Transaction

Define the filter options,

Click on Inquiry,

Payment Received into Foreign Currency Bank

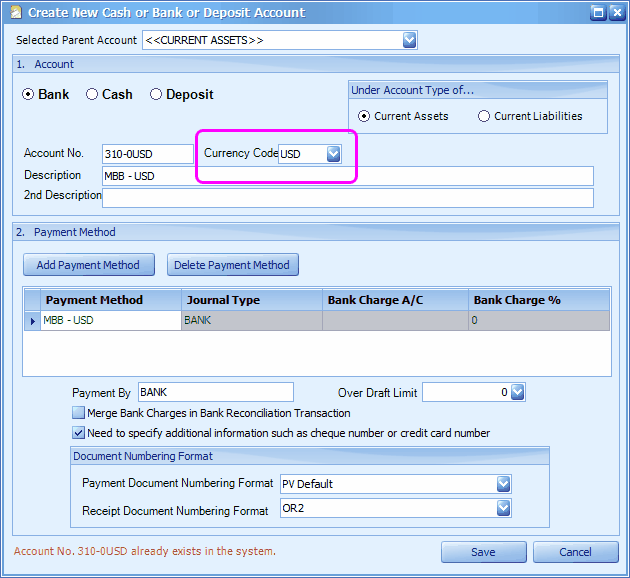

You may also record payment received in foreign currency by debiting into a foreign currency bank account,

First of all, you need to create a bank account in USD. The parent account (if any) should not be a Home Currency account)

Then, go to A/R > A/R Receive Payment

Click on Create A New A/R Payment,

Select a debtor with foreign currency,

The Currency and default currency rate is displayed,

Change the USD to MYR rate to 3.40

Click on '+' to select a payment method of Bank Account with USD, and key in payment amount (in USD), the To Bank Rate should be 1.00

Check the checkbox of an invoice to knock off.

Click on Save., OK.

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

Remember that the USD Bank Account has been debited with USD 2000.

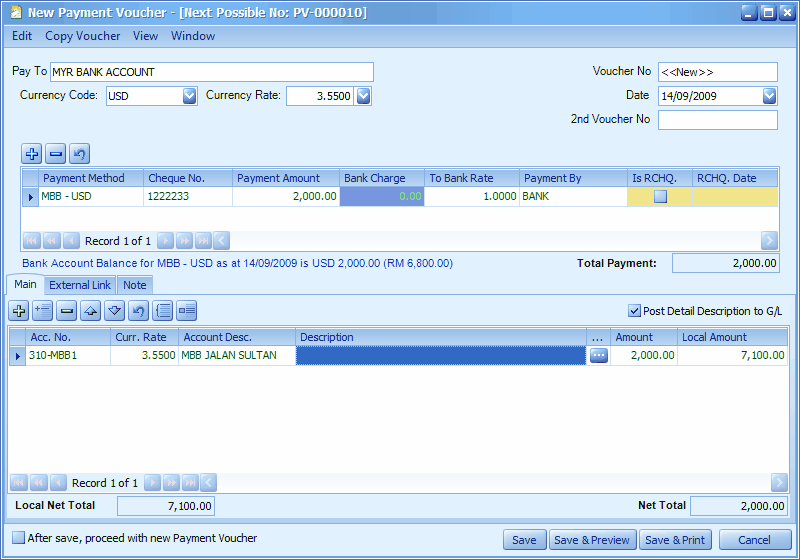

If this USD is sold/converted to home currency, an entry to record the Cash Payment (USD) and Cash Receipt (MYR) is needed to credit USD Bank Account with USD 2000 and debit a MYR Bank Account with the converted currency.

Go to G/L > Cash Book Entry

Click on Create a New Cash Transaction, New Payment Voucher

Select Currency = USD, Currency Rate = 3.55

Select Payment Method = USD Bank Account, To Bank Rate = 1.0000

Debit to a MYR Bank Account.

Click on Save.

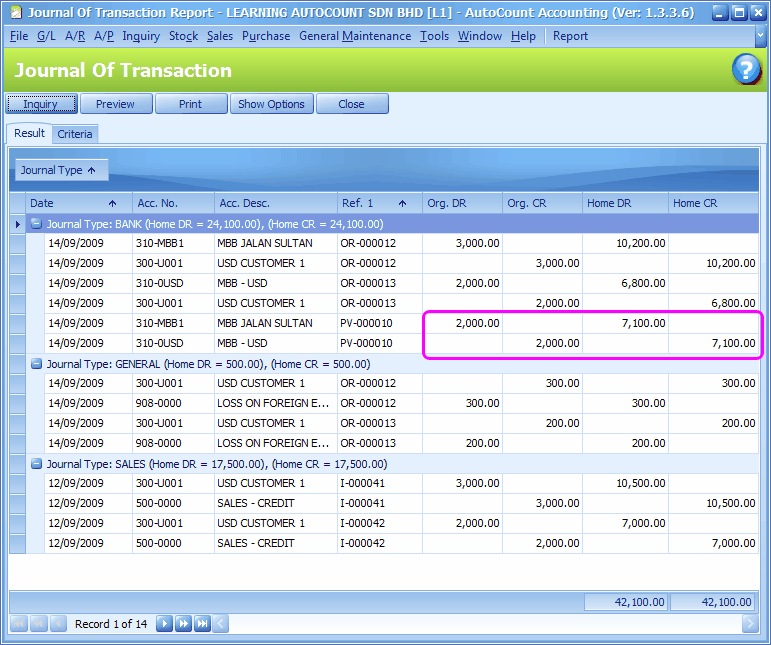

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

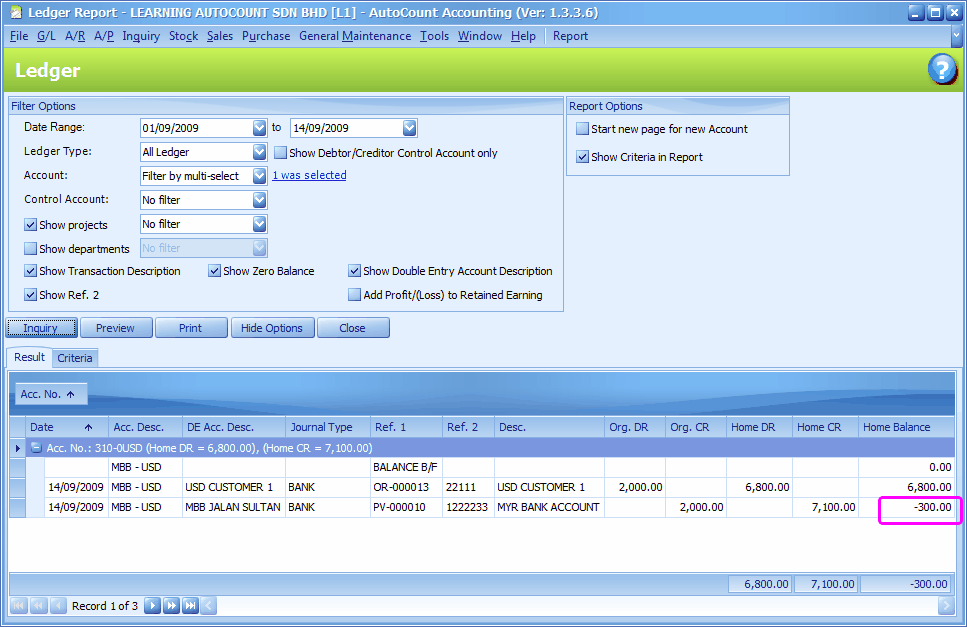

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

(The columns of Org.DR, Org.CR and Curr.Code refer to original transaction currency and transaction currency code. The columns of DR and CR refer to the currency of that specific account.)

Observe carefully USD Bank Account, the Home currency has a negative balance ( -300.00) that was caused by different exchange rates. A journal entry is needed to offset this balance in home currency and DR/CR to Gain/Loss in Exchange Rate.

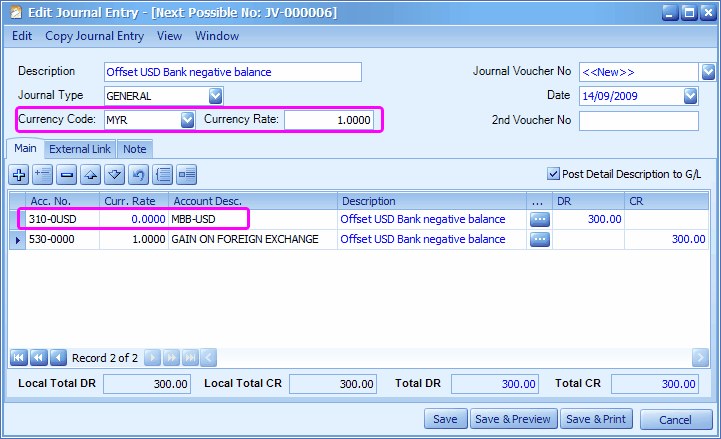

Go to G/L > Journal Entry,

Click on Add a New Journal Entry,

Select Currency = MYR

Currency Rate (for USD Bank a/c) = 0.0000

Currency Rate (for Gain on Foreign Exchange a/c) = 1.0000

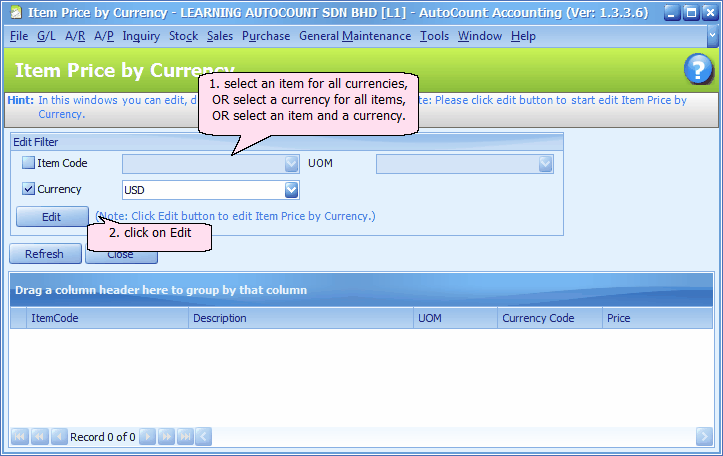

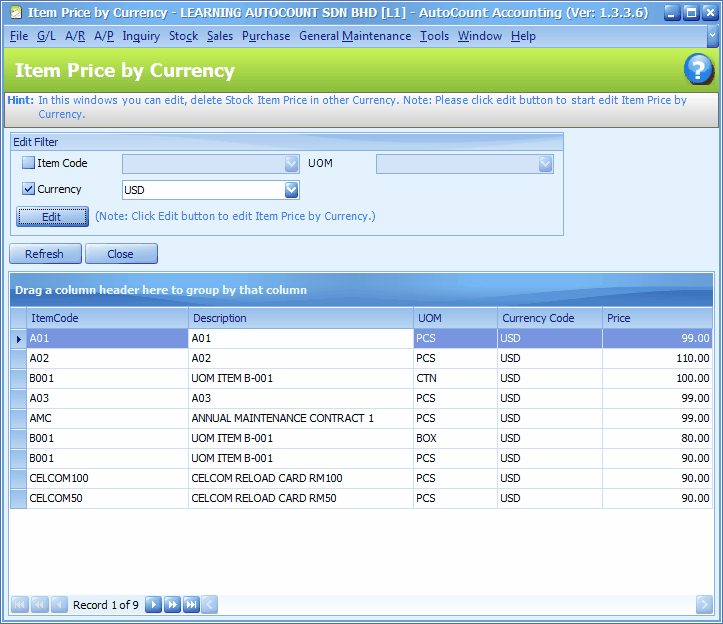

Item Price By Currency

Go to Stock > More Stock Maintenance > Item Price By Currency Maintenance

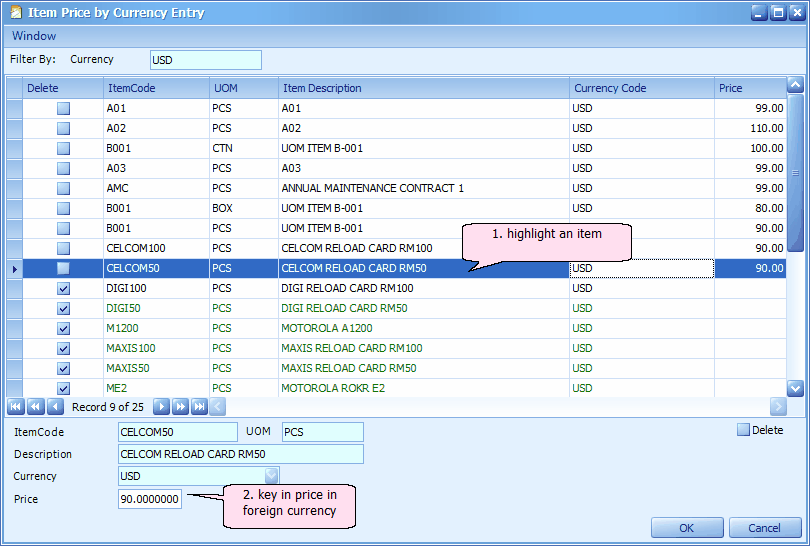

Define filter options, you must at least select one filter (either item code or currency)

Click on Edit to maintain pricing in foreign currency for selected items,

Delete: this checkbox will be unchecked when price is keyed in. If this is checked, it means the respective item will be excluded.

Click on OK.

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.