Struggling with EA Form and CP8D? The Problem May Be Your Tools (Malaysia Insights & Guide)

Key Takeaways

- EA forms reflect a full year of payroll decisions, including allowances, bonuses, overtime, adjustments, resignations, and director remuneration.

- Employers must issue EA forms to employees by 28 February, or risk penalties of up to RM20,000 or imprisonment under the Income Tax Act 1967.

- CP8D and Form E are employer submissions to LHDN, with CP8D providing detailed employee income data and Form E acting as the annual declaration.

- Key deadlines matter: EA forms by 28 February; Form E and CP8D by 31 March (subject to LHDN online extensions).

- Manual payroll, spreadsheets, and fragmented processes increase errors, rework, and last-minute firefighting.

- Modern payroll systems (AutoCount HRMS) embed tax rules and automate data accumulation, turning year-end reporting into simple consolidation.

Tax season doesn’t start in February; it starts months earlier. Miss that deadline, and problems are unavoidable.

When EA forms are late, and CP8D keeps changing, HR is often blamed first. Here's what you need to know to get everything right from the start:

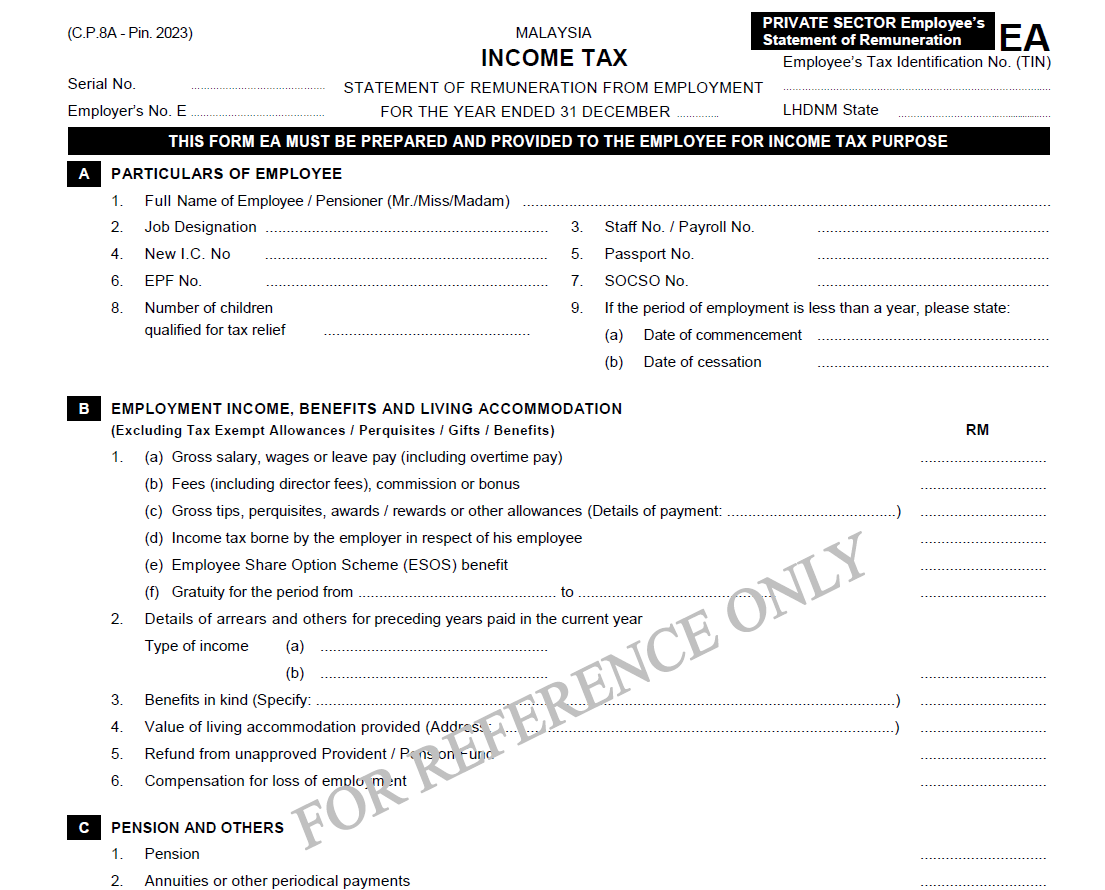

What Is the EA Form (Malaysia)?

In Malaysia, EA and CP8D are not merely year-end forms. They are the outcome of an entire year’s payroll accuracy, consistency, and documentation.

Allowances, bonuses, overtime, backdated payments, salary adjustments, resignations, and director remuneration all need to be captured correctly from the start.

Employers must:

- Provide the EA form Malaysia to all employees by 28 February following the assessment year.

- Failure to issue EA forms on time can result in penalties, including fines of up to RM20,000 or imprisonment under Section 120 of the Income Tax Act 1967.

What is Form CP8D?

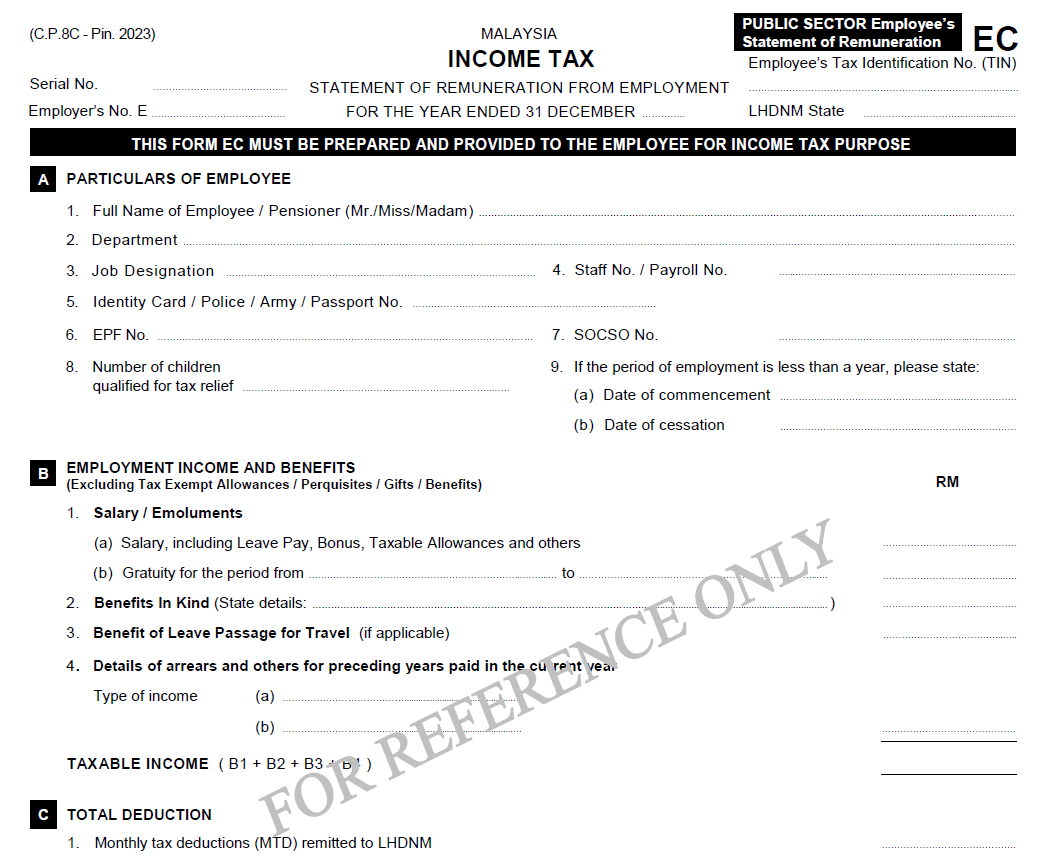

While the EA form Malaysia is given to employees, CP8D and Form E are submitted to the Inland Revenue Board of Malaysia (LHDN) by employers.

- CP8D is a detailed electronic file listing each employee’s individual income and tax deduction data submitted as an attachment to Form E via the MyTax Portal.

- Form E is the employer’s declaration of the total remuneration paid to staff during the year and confirms that all required EA forms have been issued.

Download the official CP8D Excel sheet here.

Deadlines and Compliance

Getting these forms right and on time is critical for compliance and to reduce last-minute stress:

| Form of File | Purpose | Deadline in Malaysia |

|---|---|---|

| EA form (Malaysia) | Issued to employees summarising remuneration | By 28 February |

| Form E | Employer’s summary declaration to LHDN | By 31 March (with online grace periods sometimes up to 30 April) |

| CP8D | Detailed employee remuneration file submitted with Form E | By 31 March (or per updated LHDN guidance) |

Source: LHDN

Common Pain Points at Year End

HR teams often struggle not because they lack skill, but because the underlying tools and processes aren’t built for compliant, year-round payroll management.

When payroll tasks are handled manually via spreadsheets, outdated systems, or fragmented workflows, the most capable HR teams face unnecessary risk.

This results in:

- Fire-fighting at year's end

- Time-consuming reconciliation of historical payroll data

- Frequent recalculations under tight deadlines

Employees rarely see the complexity involved, and management tends to focus only on the final output, placing the professional burden fully on HR. This misalignment can damage morale and expose the organisation to compliance risks.

Why Better Tools and Modern Processes Matter

Forward-looking organisations increasingly recognise that payroll and tax compliance should be treated as continuous processes, not annual checkboxes.

When payroll systems are set up to handle EA form Malaysia, CP8D, and Form E requirements from the first pay run:

- Tax rules are built into calculations

- Earnings and deductions accumulate automatically

- Year-end reporting becomes consolidation rather than reconstruction

Good tools don’t replace HR — they support HR.

With clear calculation logic, traceable data, and compliant reporting, HR professionals can redirect their focus toward strategy, performance, and people management rather than defending numbers and fixing avoidable errors.

Reduce Compliance Risks and Elevate HR’s Role

If EA and CP8D preparation still feels like a yearly uphill battle in your organisation, the real question might not be whether HR is competent but whether your payroll and reporting approach is still fit for today’s regulatory and operational complexity.

With the right systems in place:

- HR can confidently deliver compliant EA forms and related reports

- Organisations reduce compliance risk

- HR’s professional value becomes visible and measurable

Explore how modern payroll tools like AutoCount HRMS can simplify EA and CP8D preparation today. Click here to start now.