Malaysia’s 2025 Personal Tax Filing Deadline and Key Considerations

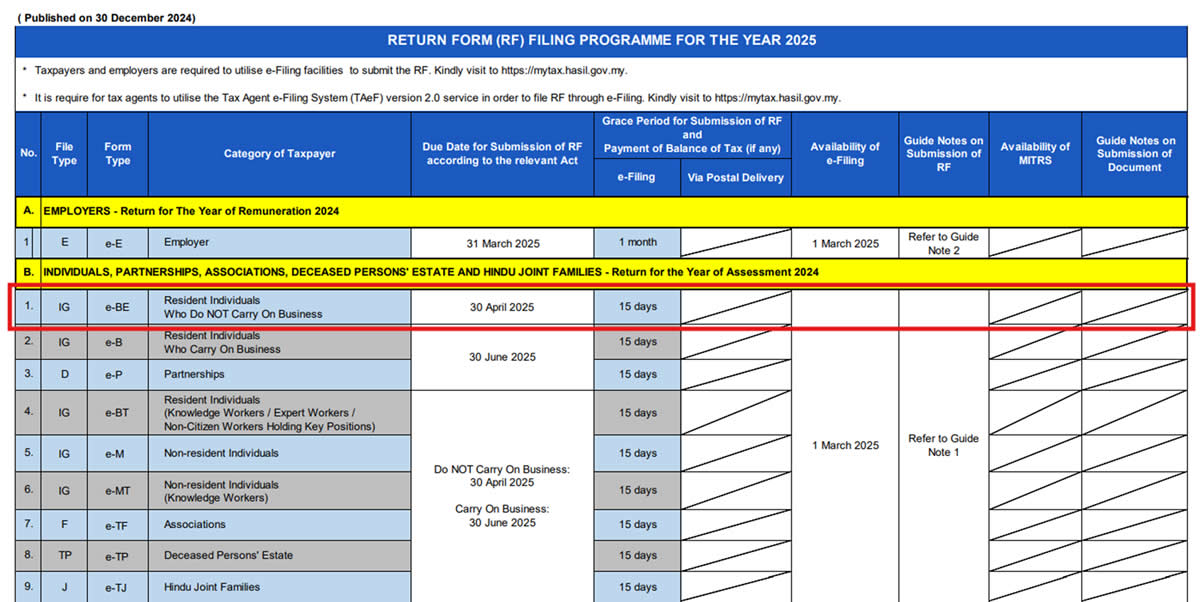

As the tax season approaches, it’s time to prepare for your annual tax obligations. The Inland Revenue Board of Malaysia (LHDN) has set the deadline for the submission of the Income Tax Return Form (RF) electronically (e-filing) for the Year of Assessment 2024 as 30th April 2025. This means all employed taxpayers must submit their annual Borang e-BE before this date to avoid penalties and complications.

Has Your Employer Provided Your EA Form?

Before you file your taxes, ensure you have received your EA Form from your employer. This document is crucial in ensuring your tax filing is accurate and complete.

What is the EA Form?

The EA Form is an annual income statement provided by employers to their employees. It outlines the total income, tax deductions (PCB), and other tax-related information for the previous year. The EA Form is essential for employees when filing their taxes, as it ensures the correct reporting of income and tax liabilities. Employers are legally required to provide this form to their employees.

Once the employer provides the EA Form, employees are obligated to file their taxes on time, even if they do not meet the taxable income threshold. Failing to submit your taxes by 30th April can result in the following consequences:

Consequences of Late Tax Filing:

- Fines and Interest: LHDN imposes penalties for late tax submissions, typically ranging from 10% to 15% of the tax payable. Unpaid taxes will also accrue interest, increasing your financial burden.

- Impact on Credit Record: Failure to file or pay taxes on time can affect your credit score, making it harder to apply for loans, credit cards, or other financial services in the future.

- Legal Action: If you repeatedly fail to file or pay taxes, LHDN may take legal action, such as freezing bank accounts, seizing assets, or even criminal prosecution.

- Loss of Tax Reliefs and Incentives: The government offers tax reliefs and incentives (such as for medical and education expenses). Missing the filing deadline may result in losing these benefits, increasing your overall tax liability.

What Happens if Companies Fail to Provide the EA Form by 31st March?

If your employer does not provide the EA Form by 31st March, they may face the following consequences:

- Penalties: LHDN can impose fines on companies that fail to provide the EA Form on time. These fines can create financial pressure on the company.

- Audit Risk: Companies that fail to provide the EA Form may be subject to increased scrutiny by LHDN.

- Employee Complaints: If employees cannot file their taxes due to the missing EA Form, they may lodge complaints with LHDN, which could lead to further investigations into the company.

- Loss of Tax Reliefs and Incentives: The government offers tax reliefs and incentives (such as for medical and education expenses). Missing the filing deadline may result in losing these benefits, increasing your overall tax liability.

How to Simplify Tax Filing for Your Company as an Employer

Preparing tax documents can be time-consuming and complex, but employers must complete them on time to avoid penalties. Many businesses simplify this process by outsourcing payroll or using payroll systems. AutoCount HRMS is an all-in-one solution that ensures compliance with LHDN regulations, making it easy to generate tax documents quickly and accurately, anytime, anywhere.

Discover how AutoCount HRMS can streamline your company’s tax filing process: https://go.autocountsoft.com/3Yr350j