e-Invoicing in Malaysia: 3 Things B2B & B2C Business Owners Should Know

If you’re an SME business owner in Malaysia, you’ve likely heard about the mandatory e-Invoicing implementation announced by the Inland Revenue Board of Malaysia (LHDN). Whether you operate Business-to-Business (B2B) or Business-to-Consumer (B2C), understanding how e-Invoicing works and the key deadlines is essential to ensure smooth compliance and avoid penalties.

In this article, we’ll guide you through:

- The latest e-Invoicing deadlines in Malaysia

- How e-Invoicing works for both B2B and B2C transactions

- The two available methods for e-Invoice submission

3 Important Things You Need to Know About e-Invoicing in Malaysia

- The Latest Deadlines for e-Invoicing Implementation

The e-Invoicing implementation is being introduced in phases, with revised deadlines that offer some relief for smaller businesses. Companies with annual revenue below RM500,000 are exempted.

Here's the latest e-Invoicing implementation timeline:

- Phase 1: August 1, 2024 - Annual revenue over RM100 million

- Phase 2: January 1, 2025 - Annual revenue above RM25 million up to RM100 million

- Phase 3: July 1, 2025 - Annual revenue above RM5 million and up to RM25 million

- Phase 4: January 1, 2026 - Annual revenue above RM1 million and up to RM5 million

- Phase 5: July 1, 2026 - Annual revenue up to RM1 million

- How e-Invoicing Works for B2B & B2C Businesses

The e-Invoicing process differs between B2B and B2C transactions.

Here’s what you need to know:

- B2B e-Invoicing Process:

- For B2B transactions, the e-Invoicing process is mandatory and more structured.

- Supplier issues an e-Invoice via MyInvois Portal or through API integration.

- The invoice is validated in real time by LHDN, and a Unique Identifier Number (TIN) is assigned.

- Both supplier and buyer will then receive notification of the validated e-Invoice.

- Supplier shares the validated e-Invoice (with QR code) to the buyer (PDF or image format).

- Buyer may reject the e-Invoice within 72 hours with valid justification.

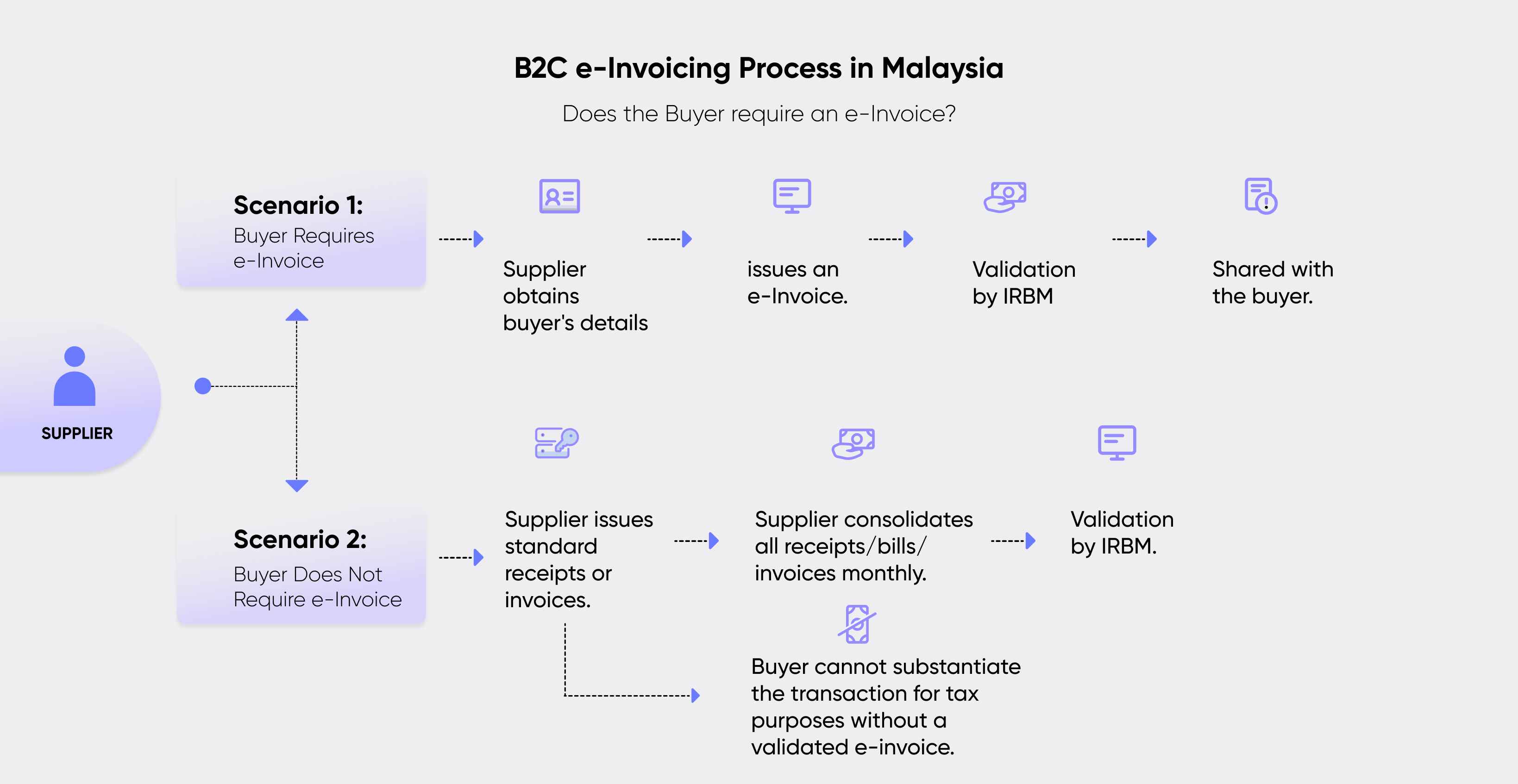

- B2C e-Invoicing Process:

- While B2C e-Invoicing is also mandatory, its application depends on whether the buyer requires an e-Invoice.

- If the buyer requests an e-Invoice, the supplier must collect buyer details and submit the invoice for LHDN validation (similar to B2B).

- If the buyer does not require an e-Invoice, the supplier issues a normal receipt or invoice and consolidates these transactions into a monthly e-Invoice report submitted to LHDN by the 7th of the following month.

- ⚠️ Important note: End consumers cannot claim tax relief unless they receive a validated e-Invoice.

The B2C process is explained in the chart below.

(Source: https://www.cleartax.com/my/en/e-invoicing-malaysia & https://www.bdo.my/en-gb/insights/featured-insights/guide-to-e-invoicing-in-malaysia

- B2B e-Invoicing Process:

- Two Methods to Submit e-Invoices: MyInvois Portal vs. API Integration

- MyInvois Portal

A web-based platform provided by IRBM and accessible by all taxpayers. Ideal for smaller businesses with lower transaction volumes.

- API Integration

Larger businesses or those using accounting software may opt to integrate directly with IRBM’s MyInvois system via API. This method automates the e-Invoicing process, reduces manual errors, increases efficiency, and allows seamless integration with existing systems. For example, solutions like AutoCount Cloud Accounting offer seamless e-Invoice submission via API.

The key features and considerations for these two methods are outlined as below:

Method Suitable for Key Features MyInvois Portal (Web-based)

- Micro & small businesses

- Low transaction volume

- Organisation with minimal IT support

- Manual entry or batch upload via Excel

- Free to use with no development cost

- Simple user interface

- Accessible via MyTax login

- Built-in field validation

- Immediate availability

API Integration (System-to-System)

- Medium & large businesses

- High transaction volume

- Businesses using ERP/accounting systems

- Organisations with strong IT capabilities

- Automated e-Invoice generation and submission

- Seamless integration with existing systems

- Scalable for large volumes

- Real-time validation

- Reduces human error

- Enables full digital workflow

Business owners can choose between two methods for submitting e-Invoices, depending on their business scale and operational setup:

Get Ready for e-Invoicing Compliance in Malaysia

The introduction of LHDN e-Invoicing is a major step toward Malaysia’s digital tax transformation. By understanding the timeline, the B2B vs. B2C requirements, and choosing the right submission method that meets your operational needs, your business can stay compliant and operate more efficiently.

Don't wait until the deadlines impact your business. Start planning your e-Invoicing journey today