The Easiest Way for SMEs and HRs to Calculate in Malaysia (2025)

For small and medium-sized enterprises (SMEs) and HR professionals in Malaysia, managing payroll often feels like navigating a constant maze of ever-changing regulations. Yet, ensuring accurate calculations for employee salaries, EPF, and SOCSO isn't just important - it's critical to avoid costly penalties and operational headaches.

But it's 2025. The good news? There are now far more straightforward ways to handle these essential calculations - accurately and efficiently. This allows you to truly focus on what you do best: growing your business and supporting your employees. Read on to discover the easiest (and most effective) path to stress-free payroll and regulatory compliance.

The Essentials: Understanding Payroll, EPF & SOCSO

Before we dive into the "how," let’s briefly go through the components:

- Payroll: This is the process of calculating and paying employee salaries, wages, bonuses, and deductions.

- EPF (Employees Provident Fund): A mandatory retirement savings scheme for private sector employees in Malaysia. Both employers and employees contribute a percentage of the employee's monthly wages.

- SOCSO (Social Security Organization): Provides social security protection to employees and their dependents against employment injuries, occupational diseases, and invalidity. Contributions are also mandatory for both employers and employees.

While these are mandatory, the calculations can be complex, considering various salary components, contribution rates, and ever-present regulatory updates.

Why Manual Calculation is No Longer the "Easiest Way"

Let's be honest: manual calculation is not only prone to errors, but also incredibly time-consuming, especially when you have numerous other tasks demanding your attention. A single miscalculation can lead to incorrect payments, unhappy employees, and penalties from regulatory bodies, putting your business at significant risk.

Furthermore, if your records aren't stored on a secure platform, they could be lost or compromised, leading to major data integrity issues.

Relying solely on spreadsheets and manual methods is simply not the most efficient or secure approach anymore in 2025.

The Easiest Way: Adopting A Dedicated Payroll Software

Increasingly, businesses are adopting robust human resource management systems (HRMS) for automation, leading to a significant reduction in payroll and compliance errors. Here's how a dedicated HRMS becomes the easiest way to manage your essential calculations:

- The Latest Deadlines for e-Invoicing Implementation

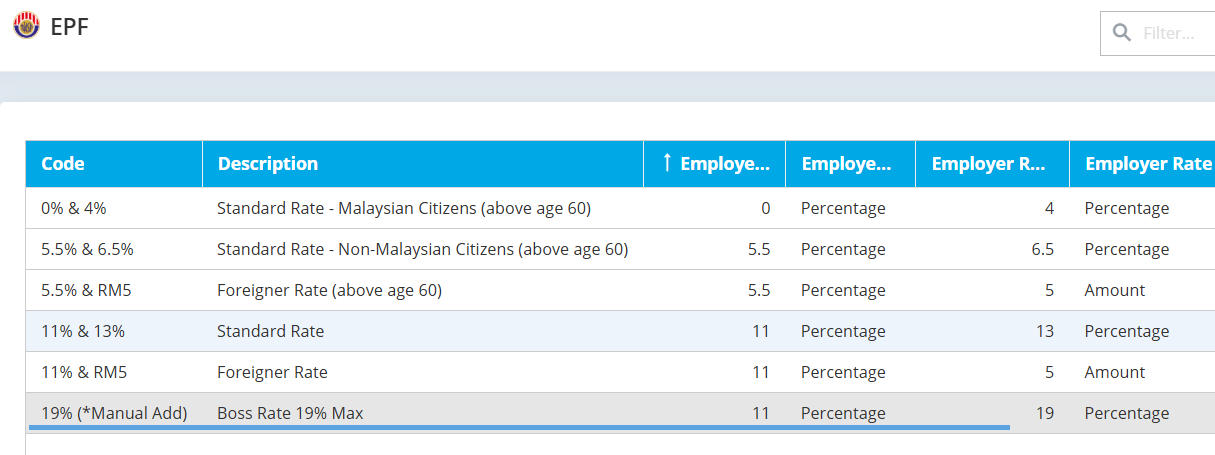

A comprehensive cloud HRMS comes with pre-set rates for EPF, SOCSO, and other statutory contributions, all aligned with the latest legal standards. You can often customise these as needed, adding specific ratios for individual employees. For instance, software like AutoCount HRMS proactively updates its parameters for its users following the minimum wage adjustments in Malaysia. Their users don’t have to worry about missing government updates or making human errors from outdated manual calculations.

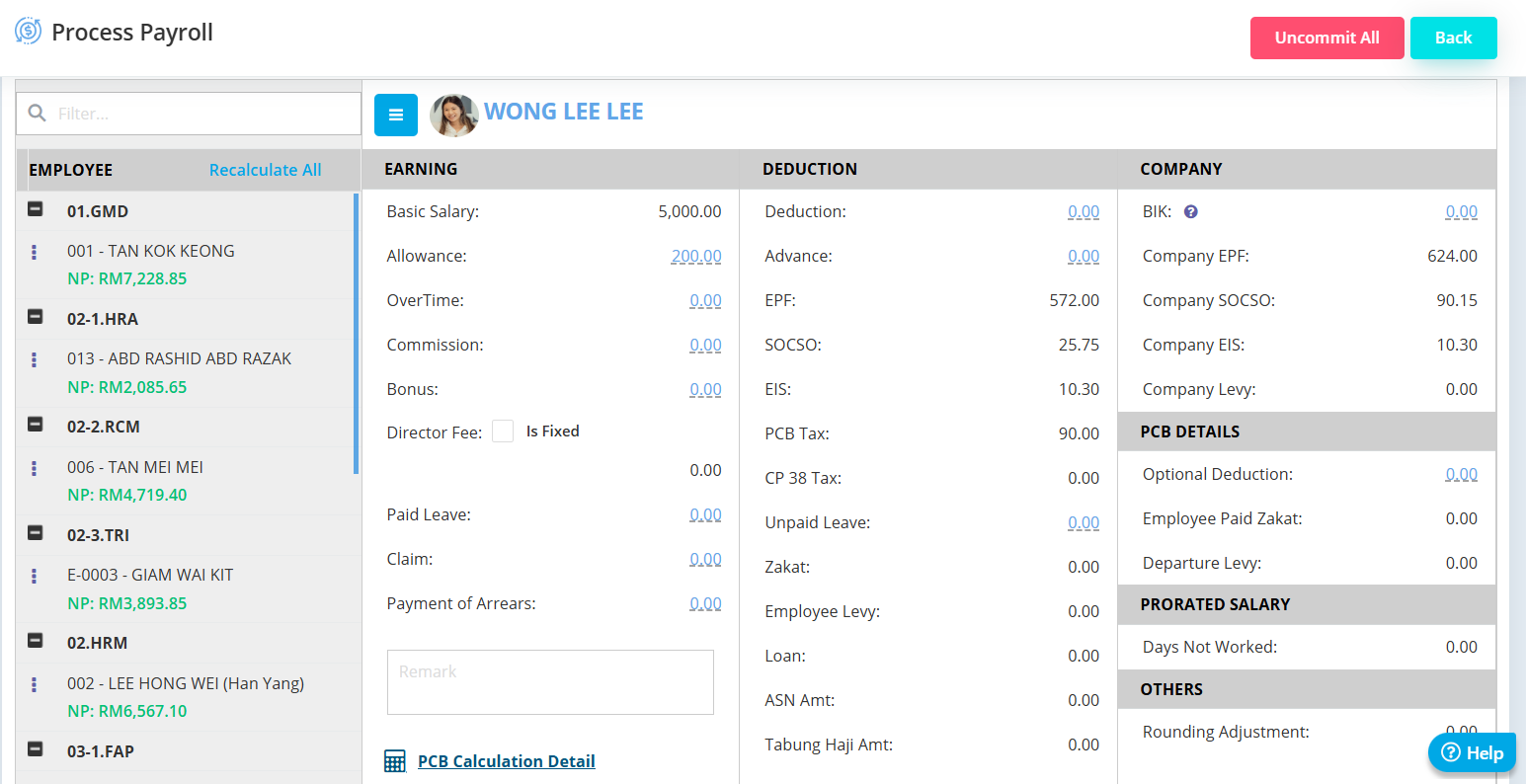

- Automated Calculations, Minimal Errors

When it’s time to process monthly salaries, an HRMS software automatically calculates EPF, SOCSO, EIS (Employment Insurance System), and PCB (Potongan Cukai Berjadual / Monthly Tax Deduction). Your HR team just needs to review without having to check the rates, eliminating the need for tedious manual lookups and calculations. This is particularly valuable for SMEs with limited manpower.

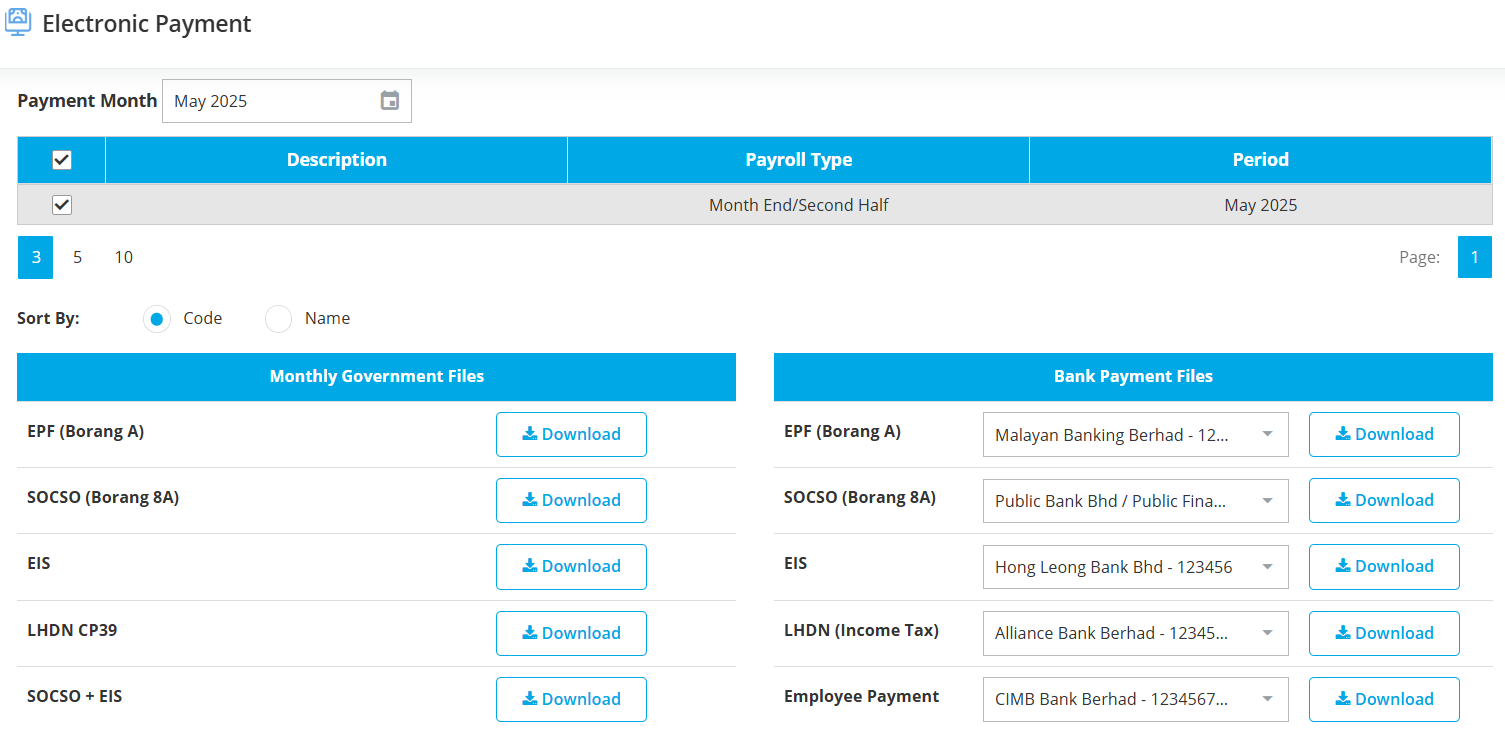

- Effortless Reporting & Batch Submissions

Generate essential reports for internal review, regulatory submissions, and audit purposes with just a few clicks. Beyond reports, a comprehensive system like AutoCount HRMS provides batch files formatted to meet Malaysian government and most local bank requirements. This means you can upload all your employees' EPF, SOCSO, EIS, or PCB submissions to government or bank platforms in one go, without any hitches.

- Secure Data Management

Employee data is sensitive. A good payroll or HRMS software should provide secure storage and access controls, protecting confidential information. AutoCount HRMS guarantees customers security by using Microsoft Azure, a world-class cloud storage platform.

Your Path to Stress-Free Payroll in 2025

Calculating payroll, EPF, and SOCSO doesn't have to be a source of stress. By moving away from manual methods and embracing the power of dedicated payroll software, SMEs and HR professionals in Malaysia can achieve unparalleled accuracy, efficiency, and peace of mind.

Invest in the right tools, and transform your payroll process from a daunting task into a smooth, automated function. For a more comprehensive look at what to prioritise and the full benefits of a robust HRMS solution, be sure to read our detailed article: How to Choose the Best HRMS In 2025: Stay Compliant and Work Smarter.