e-Invoice Implementation Timeline Update

A revision to the new e-Invoice implementation timeline for businesses has been announced during the Malaysian Budget 2024.....

The Inland Revenue Board of Malaysia (LHDN) is introducing mandatory e-Invoicing in phases for all commercial taxpayers, starting with the first phase on August 1, 2024.

The Inland Revenue Board of Malaysia (LHDN) is introducing mandatory e-Invoicing in phases for all commercial taxpayers, starting with the first phase on August 1, 2024.

The AutoCount e-Invoice Solution - the AutoCount e-Invoice Platform (AIP), is designed to simplify your e-Invoicing processes with LHDN, boost efficiency, enhance accuracy, and ensure full compliance with LHDN regulations—all from a unified platform.

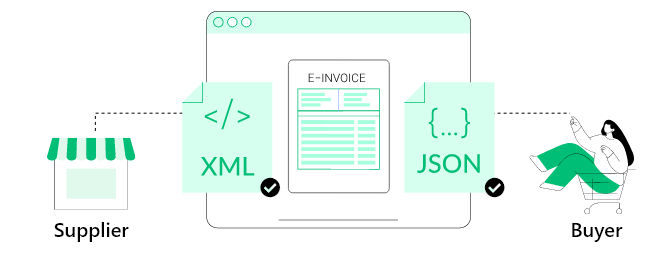

An e-Invoice is a digital proof of a transaction between a seller and a buyer, replacing traditional paper or electronic documents, with AutoCount e-Invoice Solution, business can generate, submit, process, and receive e-Invoice from LHDN MyInvois, in the officially recognized XML or JSON format, and promotes better efficiency by simplifying entire process.

AutoCount AIP bridges the gap between businesses and the LHDN, enabling direct submission of e-Invoices to the LHDN MyInvois system through the familiar AutoCount software interface. This functionality covers generation of Standard, Consolidated, and Self-Billed e-Invoices. Additional transactions with Peppol standard* invoicing will soon made possible to match more transactions which runs on Peppol system.

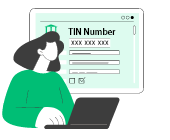

A unique URL can be sent to the suppliers or customers to fill in their TIN number and company details to automate your information collection and update process.

Appoint an approver to verify the details on invoices, and errors can always be rectified before submitting to LHDN.

In the case of LHDN MyInvois System downtime, all invoices that were uploaded will be in queue and keep trying to reupload until LHDN validated them.

Automate the process of generating and submitting consolidated and self-billed e-Invoices directly from AutoCount e-Invoice Solution.

AutoCount Solutions with e-Invoice features

Experience seamless integration between AutoCount software and the LHDN MyInvois system, enhances operational efficiency, accuracy, and full compliance with the latest LHDN regulations.

Streamline the collection of customer information, such as TIN numbers and company details, with a single click or through a quick QR code scan. With the retry mechanism in AutoCount e-Invoice Platform, the invoices will be resubmitted if LHDN MyInvois System is down, significantly reducing manual effort and ensuring swift and efficient operations.

Appoint an approver to supervise your team's e-Invoice generation and submission processes, ensuring the accuracy and integrity of data prior to direct transmission to the LHDN MyInvois System, significantly reduces concerns over errors.

A revision to the new e-Invoice implementation timeline for businesses has been announced during the Malaysian Budget 2024.....

Many may wonder, if E-Invoice introduced by LHDN promotes an efficient, time saving, and more transparent invoicing process.....

The LHDN e-invoice is a standardized e-invoice format that transmits through electronic system that stand between issuer(supplier) and receiver (buyer).....

Name and Terms in e-Invoice that You Should Know.....

Contact us now to find out more!